Types - Simple / Weighted / Exponential

Moving Averages theory is the most conventional theory and is used by most Analysts very successfully. Though at times the Moving Averages give late signals, but they are safe and work more often than not and help us determine the trend of the market.

Commonly used Moving Averages are

- Simple Moving Average (SMA)

- Weighted Moving Averages (WMA)

- Exponential Moving Averages (EMA)

SMA gives equal weightage to all the data.

WMA gives more weightage to the latest data.

EMA has the best of both and covers a larger period of time. It is the most popular as it helps spot early signals.

Different Combinations of Moving Averages

Most Traders prefer a combination of 3 MA s for confirmation.

Some of the common combinations used are:

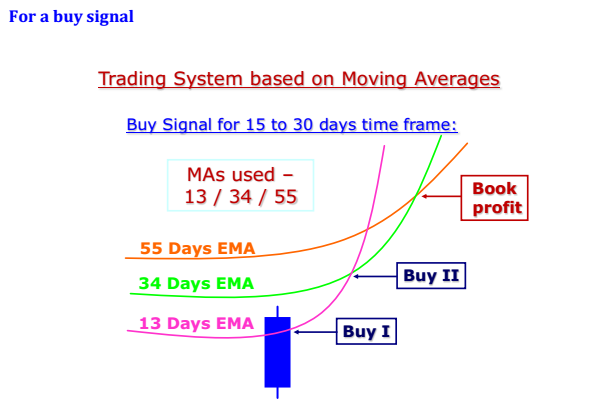

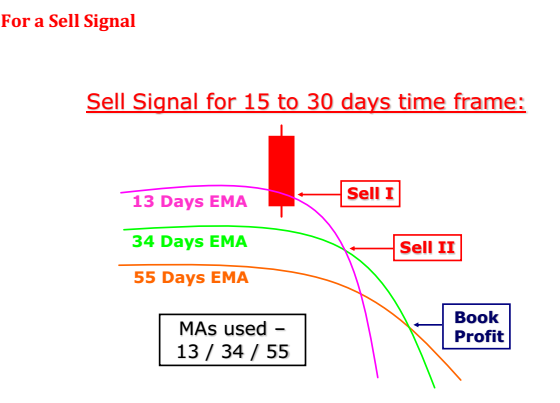

- 13 / 34 / 55 - For a move in 15 to 30 trading sessions.

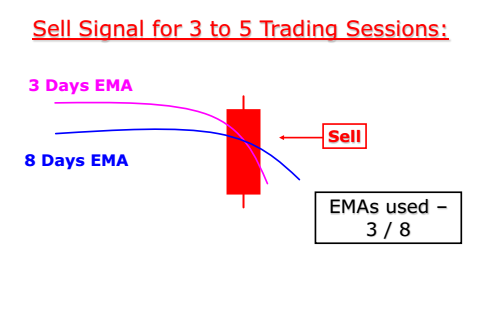

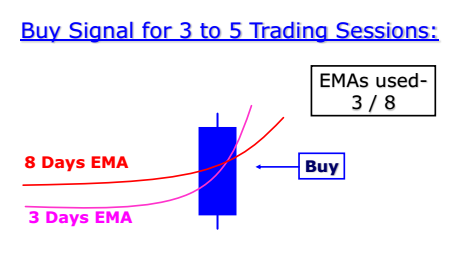

- 3 / 08 / 13 - For a move in 5 to 8 trading sessions.

- 1 / 3 / 5 - For a move in 2 to 3 trading sessions

- 1 hour/ 3 hours / 5 hours - For Intra-Day to 1 day.

Moving Averages theory is a confirmatory theory and is criticized on the count that many a times it gives late signals but the positive thing is that it gives confirmed signals.

MOVING AVERAGE TRADING SYSTEM WITH A 3 TO 4 WEEKS VIEW

Signals in respect of Moving Averages

Signals from MA s.

- 3 MA s should be almost parallel and equidistant and turning upwards.

- The 3 MA s should be in the Ascending order i.e. lowest MA at the bottom, and highest MA at the top.

- The first signal to buy (Anticipatory) is when the price cuts the Short term MA from the bottom.

- The second signal to buy (Confirmatory) is when the Short term MA cuts the Long term MA from the bottom which confirms that the trend is going to continue.

- When the 2nd MA line cuts the third MA line, though the trend continues to remain up, a good correction normally occurs and one should book profits.

- In case the trend changes in between, the Short term or the lowest MA will turn down. If this happens one should exit the stock.

When the trend changes from up to down.

- 3 MA s should be almost parallel and equidistant and turning downwards.

- The 3 MA s should be in the order such as the lowest MA at the top, and highest MA at the bottom.

- The first signal to sell (Anticipatory) is when the price cuts the Short term MA from the top.

- The second signal to sell (Confirmatory) is when the Short term MA cuts the Medium term MA from the top.

- When the 2nd MA line cuts the third MA line, though the trend continues to remain down, a good correction normally occurs and one should book profits.

- In case the trend changes in between, the Short term or the lowest MA will turn up. If this happens one should exit the stock.